The Ultimate Guide To Stonewell Bookkeeping

Table of ContentsSome Known Facts About Stonewell Bookkeeping.Some Ideas on Stonewell Bookkeeping You Should KnowLittle Known Questions About Stonewell Bookkeeping.What Does Stonewell Bookkeeping Do?What Does Stonewell Bookkeeping Mean?

Most recently, it's the Making Tax Obligation Digital (MTD) campaign with which the government is expecting services to conform. Accounting. It's precisely what it states on the tin - companies will need to start doing their taxes electronically with the use of applications and software. In this case, you'll not just need to do your books yet likewise utilize an app for it.You can rest easy recognizing that your company' economic info is prepared to be reviewed without HMRC giving you any kind of stress and anxiety. Your mind will be at simplicity and you can concentrate on various other locations of your organization.

The Facts About Stonewell Bookkeeping Uncovered

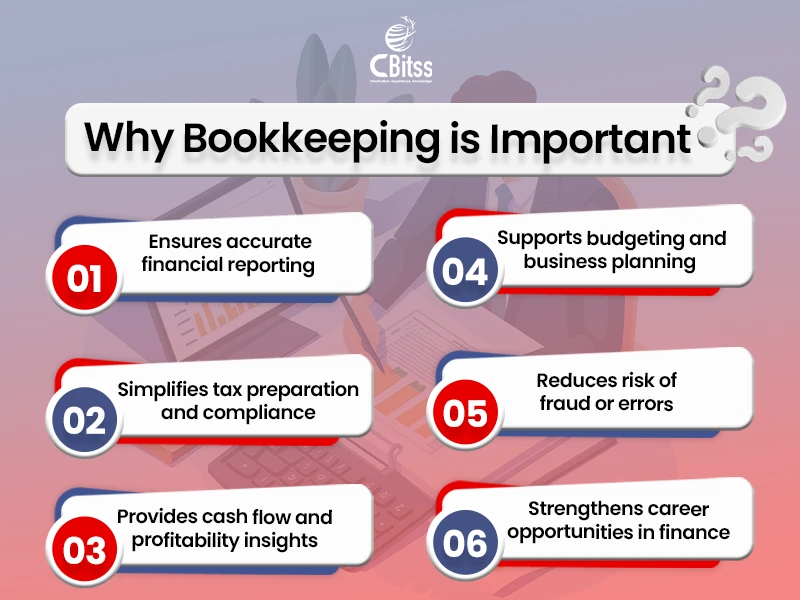

Bookkeeping is important for a small company as it helps: Display financial health and make notified decisions, consisting of cash money circulation. Mobile accounting applications offer several benefits for little service owners and business owners, simplifying their economic monitoring jobs (https://picturesque-banjo-03b.notion.site/Bookkeeping-The-Secret-Ingredient-to-Your-Business-Success-2cbf4baeeb2e80ad8c5ec5e55b1efc15?source=copy_link).

Numerous contemporary bookkeeping applications permit users to link their bank accounts directly and sync the purchases in real time. This makes it much easier to check and track the earnings and expenses of business, removing the demand for hands-on entry. Automated functions like invoicing, expenditure tracking, and importing financial institution deals and financial institution feeds save time by reducing hands-on information entrance and improving audit procedures.

In addition, these applications reduce the demand for working with extra staff, as several jobs can be managed in-house. By leveraging these benefits, local business owners can enhance their economic administration procedures, boost decision-making, and focus much more on their core service procedures. Xero is a cloud-based bookkeeping software that assists local business easily handle their accountancy records.

That "successful" client may in fact be costing you money when you aspect in all expenses. It's been haemorrhaging money for months, however you had no method of knowing.

The 8-Second Trick For Stonewell Bookkeeping

Below's where accounting ends up being really exciting (yes, really). Accurate economic documents offer the roadmap for service development. Low Cost Franchise. Companies that outsource their accounting mature to 30% faster than those handling their own books internally. Why? Since they're making choices based upon strong information, not estimates. Your accounting discloses which product or services are truly rewarding, which customers deserve keeping, and where you're spending needlessly.

Presently,, and in some capability. Just because you can do something does not mean you should. Here's a useful comparison to help you determine: FactorDIY BookkeepingProfessional BookkeepingCostSoftware costs only (less expensive upfront)Service charges (usually $500-2,000+ regular monthly)Time Investment5-20+ hours per monthMinimal evaluation reports onlyAccuracyHigher error danger without trainingProfessional accuracy and expertiseComplianceSelf-managed threat of missing out on requirementsGuaranteed ATO complianceGrowth PotentialLimited by your offered timeEnables focus on core businessTax OptimisationMay miss out on deductions and opportunitiesStrategic tax preparation includedScalabilityBecomes overwhelming as service growsEasily scales with organization needsPeace of MindConstant stress over accuracyProfessional assurance If any of these sound acquainted, it's possibly time to generate an expert: Your Low Cost Franchise business is expanding and transactions are multiplying Accounting takes more than 5 hours weekly You're registered for GST and lodging quarterly BAS You utilize staff and manage pay-roll You have several revenue streams or savings account Tax period fills you with real dread You prefer to concentrate on your actual imaginative work The reality?, and specialist bookkeepers recognize just how to take advantage of these devices successfully.

Stonewell Bookkeeping - The Facts

Perhaps particular jobs have better payment patterns than others. Even if offering your organization appears far-off, preserving clean financial documents constructs venture value.

You may also overpay taxes without proper documents of reductions, or face troubles during audits. If you find mistakes, it's crucial to remedy them without delay and modify any kind of affected tax obligation lodgements. This is where expert accountants show important they have systems to capture errors before they end up being pricey troubles.

At its core, the main difference is what they do with your financial data: handle the daily jobs, including recording sales, expenses, and financial institution settlements, while maintaining your basic journal approximately day and exact. It's about obtaining the numbers ideal constantly. action in to analyse: they check out those numbers, prepare monetary statements, and translate what the data actually indicates for your company development, tax obligation position, and productivity.

Get This Report on Stonewell Bookkeeping

Your company decisions are only just as good as the records you have on hand. It can be tough for company owner to individually track every expenditure, loss, and earnings. Preserving precise documents calls for a great deal of work, also for local business. Do you recognize just how much your service has spent on payroll this year? Just how around the amount spent on stock so much this year? Do you know where all your invoices are? Company tax obligations are intricate, time-consuming, and can be demanding when trying to do them alone.